State of Governance 2024 - Trends and tips to accelerate your impact as sustainable directors and investors

On 16 January 2024, GUBERNA and Euronext held their annual New Year Event, gathering Belgian leaders, investors, entrepreneurs and directors. The evening revolved around Sustainable finance: transitioning towards high impact. Sandra Gobert, executive director at GUBERNA, set the stage with her opening speech which you can read here.

2023 – A year of multiplying crises

Dames en heren, mesdames et messieurs, meine Damen und Herren, ladies and gentlemen,

Welkom, herzlich wilkommen, bienvenue, welcome to our New Years Event!

As the video showed, 2023 has been no rose garden, but there was good news: inflation calmed down from 10% to 3%, the energy transition scaled up, supply chains have proven sufficiently resilient.

But winds have not turned at the beginning of the new year: from bloody winter campaigns in Ukraine, from Israel and Palestina to Japan, from Libya over the Red Sea to China and Taiwan, the turmoil is not over yet.

Four global changes set the agenda in 2024

So, yes, 2023 ended “foggy” and 2024 starts with a foggy horizon.

Nevertheless, as the Israeli peace-activist Etgar Keret writes : "(...) we have to allow ourselves to be confused and to look for answers, not to have them instantly.". With input from our experts and team members, we have collected the most important trends and we think that, despite the fog, we have a duty to be optimistic.

As a knowledge institute, we know that it is necessary to look at challenges in a balanced way: only then you can distill solutions and start working with them. We are therefore happy to share with you the State of Governance 2024 and our trends and tips to accelerate your impact as sustainable directors and investors.

A (geo)politically decisive year

First, 2024 will be a geopolitically decisive year. Global instability keeps rising.

On top of that, it will be a multi-electoral year. There will be more than 70 elections all over the world. More than half of the world population, will go to the polls and test the global state of democracy.

The US elections will fundamentally affect climate policy, European security and the relationships with China. Within Europe, European institutions have gained more power and will continue to translate this in net-zero regulations and geopolitical standpoints.

We cannot ignore these events. We are living in high-connected world, in which no country can survive by itself. In 2024, crucial choices will be made, not only for the world and for Europe, but also for our companies.

A year of scaling up energy and infrastructure investing

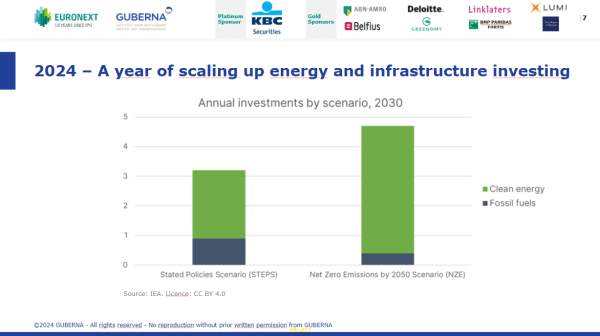

Besides a geopolitically pivotal year, 2024 will also be a year of massive investing. A new clean energy economy is emerging and gives hope for the future. According to the International Energy Agency, we are on track to see all fossil fuels peak before 2030. However, additional progress is needed to meet the only scenario which limits global warming to 1.5 degrees.

As you can see on the graph which shows a comparison between the Net Zero Emissions scenario and the STEP Scenario, the key to an effective transition is to significantly scale up investments: triple the renewable energy capacity, double the pace of energy efficiency improvement, speed up electrification and cut down methane emissions with no further delay.

In 2024, Europe will be negotiating international trade agreements, scaling up net-zero technology subsidies and simplifying procedures and permitting. The moment has thus come to make crucial financial investment decisions.

A year to set AI governance in motion

But 2024 will also oblige all sectors to look more closely at the governance of new technologies.

AI tools have explosively grown over the last year. According to the McKinsey Global Survey 2023, one third of the respondents declare that their companies are regularly using artificial intelligence and 40% will increase their investments in 2024.

In ¼ of companies it is on the board’s agenda. Regulators are exploring legislation. Shareholders and stakeholders are increasingly worried.

In 2024, companies will be confronted with the risks generated by the use of artificial intelligence itself: the main risk of inaccuracy, the data and security risks, the ethical sides, the fundamental changes it can bring to the workforces and eventually, to the business model itself.

A year to implement sustainability

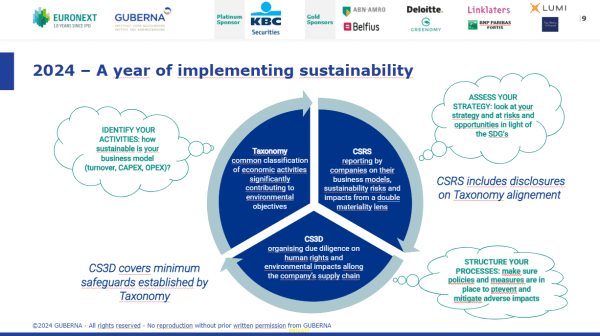

Reporting on sustainability is a fact now. Under the watchful eyes of increasingly involved boards of directors, companies will be linking European regulations as shown on this visual.

They will identify the sustainability of their activities under the taxonomy, assess risks and opportunities to report on them under the CSRD and put in place appropriate policies and procedures under the upcoming CS3D.

Besides the European legislation, 2024 will be the year of two global ESG standards as well as hopefully the long awaited American regulation.

Implementing sustainability will thus be the fourth big topic companies will have to deal with in 2024.

4 Tips to boost your board in 2024

How should boards deal with these four 2024 challenges? Should they, as European Commission president Ursula von der Leyen puts it, further “derisk”, or should they “decouple?”. We have distilled 4 recommendations for you to start the year with.

Become strategically agile

Since the pandemic, companies have become increasingly resilient, adapting constantly to survive. Today, the time has come to integrate this agility into your strategy.

To do so, risk governance should be a major topic on the board’s agenda and approached in a strategic manner: enterprise-wide and proactively, identifying opportunities. Boards should review operational and leadership structures and ask themselves if they are robust enough in different scenarios.

In short, boards should shift their mindset from defensive to offensive: if we were disrupted, when and how would we know?

Vigilantly engage with shareholders

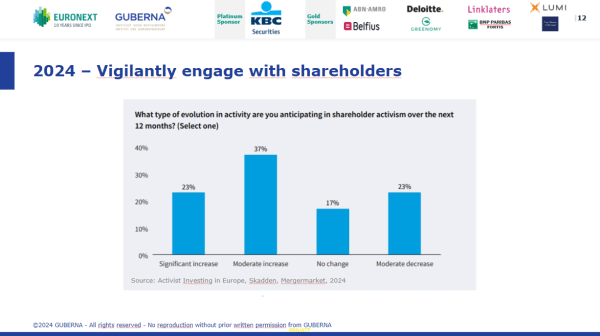

Secondly, boards should interact even more with their shareholders.

Investor activism has grown significantly in Europe with a record of 69 campaigns launched in 2023. The findings of a survey published last week by Skadden confirm that half of the respondents expect this form of activism to increase even further in 2024.

Of course, good shareholder relations are not new. Corporate governance Codes, including the Code 2020, already emphasize the importance of the shareholder’s dialogue, but is gets even more crucial.

So boards should put this dialogue front and center in their practices and engage with the shareholders proactively.

Take a critical and open-minded look at your governance

All good things come in threes, so we have another tip for you. Because, of course, shareholders’ involvement is not sufficient: stakeholders should also be heard.

Some scientists claim that, like the non-profit, the corporate board should also include stakeholders and be more democratic. Others propose to install a bicameral system, where the board of directors would be doubled by a second decision making body with veto powers.

Of course, these sound like radical solutions but new times may need new and innovative approaches. In 2024 and in view of an economy where externalities are internalized and courts of law ask for stakeholders’ interests to be taken into account, companies should reflect on how to optimize their checks & balances. More than ever, there is no one size fits all in corporate governance!

Morally empower your board

Of course, expectations are increasing on boards as they are held accountable by both shareholders and several stakeholders. So, how do you deal with these conflicting interests and the dilemmas that arise?

Expertise and skills are part of the answer. As Microsoft and the Bosting Consulting Group CG rightly wrote in their report Closing the sustainability skills challenge: “Just as the world needed science education during the space age and computer science in the digital age, building a sustainable world requires that sustainability spreads into every sector of the economy.”. Education and staying constantly informed will therefore be crucial for directors in 2024.

Culture is the second ingredient of the recipe. One can speak of the 3 d’s and the 3c’s of ethics: Diversity, disagreement, decision and candor, courage and confidentiality. If you want your board to be high-functioning, break group-think by promoting trust and inclusion and encouraging candor, courage and confidentiality.

As you hear, despite the fog, we are optimistic and convinced that these 4 tips will help you to create impact:

-

integrate agility into your strategy

-

vigilantly engage with your shareholders

-

reflect on your governance in an out-of-the-box manner

-

morally empower your board

2024 – A year of sustainable impact

2024 will be the first of a series of transformational years, a year where companies, financial institutions and capital markets will start working together on a double deal: the financing of a just transition and the transformation of finance.

Let us take a bet on the future together and go for high impact! Happy New Year.

GUBERNA is ready for a year of fundamental changes. To help you as directors articulate these four tips, we will soon publish a series of podcast interviews with experts on each of the four tips. Keep an eye on our social media and newsletters not to miss anything.

Meanwhile, you can dive into a series of articles based on our 2023 Sustainable Value Creation study.