Corporate interest - balancing profit and societal value?

On Tuesday 26 March 2019, we were happy to welcome our partners, as well as 178 members at our General Member Assembly, held at Bozar in Brussels.

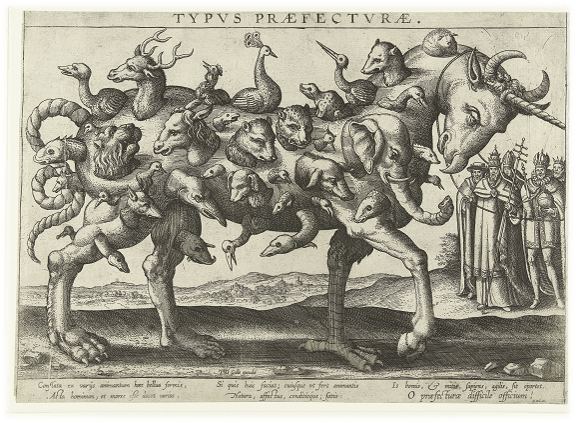

This exceptional venue showcases Pieter van der Borcht’s exquisite drawing ‘Allegorie op de moeilijkheid van het besturen’, which depicts division as a beast sowing lack of focus and mismanagement while religious and civil stakeholders are watching from the back. This drawing ties in perfectly with our central topic: corporate interest and the governance questions it raises.

This theme, which is crucial for the future of our organisations and for society at large, was vigorously debated with our partners and members at the Assembly.

Our prominent keynote speakers, Prof. Alain François (VUB, partner Eubelius), Jacques Crahay (UWE, Cosucra – Groupe Warcoing) and Saskia Van Uffelen (independent director Bpost, Elia, Axa) represented the legal perspective, the shareholder perspective and the perspective of the independent director. Their view was followed by contributions from relevant stakeholders, through the inspiring video messages of Prof. dr. Valérie Swaen (Full Professor UCLouvain, Head of Louvain CSR Network), who highlighted the role of corporate social responsibility, and by Luc Cortebeeck (President of the international Labor Organisation - 2017- 2018; Former National President of the ACV), who reflected on the participation of employees and other stakeholders as well on the importance of corporate governance for corporate interest.

Corporate interest is indeed an evolutionary concept. Historically it formed the basis for Corporate Governance, defined as a set of checks and balances ensuring that the company is managed on behalf of and in the interest of all, including non-active shareholders. The view of profit maximalization was predominant.

Bad practices and failures of the existing systems have led to an increasing role for the boards of directors in safeguarding the corporate interest, with a focus on the presence and contribution of independent board members, especially whenever alignment is needed between opposing interests.

Nonetheless, there is an international trend to no longer solely consider the interests of the shareholders, but to also take into account, directly or indirectly, the interests of the “stakeholders”. In other words, the interests of the employees, the creditors, the consumers and/or other traditional "third parties".

The revised Principles of Corporate Governance, adopted on 8 July 2015 by the OECD, explicitly underline the indirect role of stakeholders, stating that:

The board is not only accountable to the company and its shareholders but also has a duty to act in their best interests. Boards are expected to take due regard of, and deal fairly with, other stakeholder interests including those of employees, creditors, customers, suppliers and local communities. Observance of environmental and social standards is relevant in this context.

Meanwhile, the new SDG’s or Sustainable Development Goals came into effect on 1 September 2016 and must be achieved by 2030. In these objectives, which act as "soft law for Member States", all companies play a decisive and growth-oriented role on the road to a sustainable economy.

Evidently, this means that the governance model of shareholder primacy comes under pressure, if it implies that companies must be sustainable, ethically and socially responsible.

In parallel, following the financial crisis, more attention is being paid to the long-term perspective. The "stewardship role" of shareholders is being highlighted, particularly in companies that primarily work with passive shareholders or shareholders with a predominantly short-term perspective.

As such, from a societal and governance point of view, the notion of "corporate interest" evolved over the years from the pursuit of profit maximization – from short-term to long-term - to balancing the interests of all stakeholders.

From a strictly legal point of view, however, and up until the recent vote on the new Code of Companies & Associations, Belgian corporate law maintained a “blank standard” for the notion, leaving it deliberately to the courts to define the corporate interest.

As stressed by Prof. Alain François, such a definition is not an exercise free of consequences as the notion stands as a test for the validity of acts or decisions of corporate bodies, determines the liabilities of the directors as well as the validity of voting agreements between shareholders, and serves as a judicial criterium in several other company matters.

As a sort of compromise between a narrow and a broad interpretation, the Belgian Supreme Court (Cassation), in its decision of 28 November 2013, defined the notion for the first time:

"The interest of a company is determined by the collective interest of its current and future shareholders", the “future shareholders” representing the long-term perspective of the company.

Without a clear motivation in the preparatory works and by way of a rather abrupt amendment during the legislative process, the new Code of Companies and Associations (approved on the 28 February) changes the tune, introducing in article 1 the concept of multiple corporate goals allowing a broader legal definition of the corporate interest:

“A company is established by a legal act by one or more persons, called partners, who make a contribution. It has assets and is subject to the performance of one or more specific activities. One of its goals is to distribute or deliver a direct or indirect capital gain to its partners.”

In addition, the objectives set by the Corporate Governance Code 2020 emphasise sustainable value creation and want to provide the necessary foundations in terms of sustainable value creation, inclusive approach and strategy, leadership and monitoring.

As stated by the Commission Corporate Governance:

“The revision of the 2009 Code was also an opportunity for the Committee to place even more emphasis on sustainable value creation. This involves an explicit focus on the long term, on responsible behavior at all levels of the company and on the permanent consideration of the legitimate interests of stakeholders. More explicit expectations are also formulated in terms of diversity, talent development and succession planning, and in relation to the company’s annual reporting on nonfinancial matters.”

This evolution is not only reflected in hard and soft law initiatives but also clearly present in business.

As stated by Luc Cortebeeck, “corporate governance is essential for the corporate interest but also for societal interest. Only governance can lead to sustainable companies”.

A fundamental shift in mindset is needed according to Jacques Crahay: “It is clear that the actual economic model is on its last legs: it is vital to start with the question “why” and to put that question again to the shareholders”.

Saskia Van Uffelen highlighted that “attention to stakeholder interests is needed in order to successfully achieve business objectives. In a highly connected society the speed of execution increases. This has an impact on all organisations and all sectors. 65% of the jobs will change. New competencies and skills are needed. In this respect, It is important to care about our human capital!”

Of course the debate is not closed! Instead it is only the beginning, revealing numerous challenges, and yet unanswered questions.

Our Chairman Gaëtan Hannecart stated in his introduction that the board of directors decided three years ago at its strategic meeting that GUBERNA’s “corporate goal” is not to be normative in its approach to governance. We leave it to the organisations themselves to decide on their purpose. We do support them with insights and tools to achieve their purpose and therefore closely follow up on national and international developments in this respect.

It is certain that there is a growing demand from the markets (employees, consumers and investors) for more sustainability and more transparency, as well as a growing pressure to broaden the social role of corporations and to increase the liabilities of directors.

It is also certain that, if part of a proactive policy, the attention for stakeholders can be an important strategic asset.

On the other hand, one can argue that it should remain up to the shareholders, as providers of the company’s resources, to decide on the goals of the company, and in so doing setting the limits within which directors can consider relevant stakeholder interests.

But who are the ‘relevant’ stakeholders? According to Prof. dr. Swaen, one commonly thinks in terms of ‘direct’ and ‘indirect’ stakeholders, but she prefers to define a hierarchy based on three dimensions: legitimacy, power and urgency.

With an eye to balancing the various interests, governance today is defined as the exercise of ethical and effective leadership by the governing body towards the achievement of the following governance outcomes:

- Ethical culture

- Good performance

- Effective control

- Legitimacy

(Prof. Mervyn E. King, King IV report on Corporate Governance, 2016)

Besides, the above mentioned trend has also put the spotlights on enhanced transparency. Accountability of companies and boards towards a larger group of stakeholders is becoming increasingly important, but as stated by Prof. dr. Lutgart Van den Berghe, "transparency requirements should be ‘functional’. A balance should be safeguarded! Some of the current propositions are too demanding and might be detrimental for companies in reaching their objectives".

Governance indeed has a vital role to play in the framing of the company's interests, starting from the shareholders and taking into account the stakeholders as well as the social context in which the company operates. A broader notion of the corporate interest, beyond profit maximalization, is a valuable approach but it also has to be practicable. The proof of the pudding is in the eating. To be continued …