How boards can turn sustainability reporting into a strategic opportunity

Sustainability reporting is seen as the number one challenge by many companies nowadays. Indeed, the European Corporate Sustainability Reporting Directive (CSRD) requires all large companies and all listed companies (except listed micro-enterprises) to disclose information on what they see as the risks and opportunities arising from social and environmental issues, and on the impact of their activities on people and the environment.

Based on a recent “Insight session on sustainability reporting” organized by GUBERNA in collaboration with Allen & Overy and EY (March 28th, 2024), this article answers key questions about the new rules. In particular, it emphasizes the consequences for corporate governance and how boards can transform sustainability reporting from a compliance exercise to a value creation opportunity.

Why should boards care about sustainability reporting?

The preparation of the sustainability report is primarily a task of the company’s executive management. However, it has tangible implications for boards of directors and corporate governance more generally. During the insight session, Prof. Regine Slagmulder, Knowledge Director at GUBERNA, explained that sustainability reporting is intrinsically linked to the three important roles of the board.

- The oversight role: The board should monitor the compliance of the company with the legal rules (see infra). Through the audit committee, the board should also ensure that data controls are in place and that audit requirements are respected.

- The strategic role : it is the task of the board to set the strategic direction in sustainability. The GUBERNA study on sustainable value creation in listed companies (2023) provided evidence that reporting on ESG factors can be a powerful enabler of strategic action on those factors.

- The leadership role: the board is in charge of selecting, nominating, evaluating and remunerating the company’s executive team. In this respect, appropriate skills and the right incentives can facilitate proper reporting and the transition to a sustainable business model.

It is worth noting that the CSRD also requires reporting on governance factors. This includes:

- “the role of the undertaking’s administrative, management and supervisory bodies with regard to sustainability matters, and their composition, as well as their expertise and skills in relation to fulfilling that role or the access such bodies have to such expertise and skills;

- the main features of the undertaking’s internal control and risk management systems, in relation to the sustainability reporting and decision-making process;

- business ethics and corporate culture, including anti-corruption and anti-bribery, the protection of whistleblowers and animal welfare;

- activities and commitments of the undertaking related to exerting its political influence, including its lobbying activities;

- the management and quality of relationships with customers, suppliers and communities affected by the activities of the undertaking, including payment practices, especially with regard to late payment to small and medium-sized undertakings”. (Source : EUR-Lex)

This makes it even more important for boards of directors to be involved in sustainability reporting. They should be able to challenge and ask the right questions on sustainability and ESG reporting.

Other relevant articles

CSRD : what are the rules?

In this section, we provide an overview of the legal requirements and liability risks. This outline is based on the contribution of Axel de Backer, Senior Associate at Allen & Overy Brussels, during the Insight Session.

First, one must realise that the CSRD is part of a greater set of European legislation aiming at facilitating the transition to a sustainable economy. It started with the Paris Climate Agreement. One of the objectives of this agreement was to “make finance flows consistent with a pathway towards low greenhouse gas emissions and climate resilient development”. Based on that, the European Union enacted several pieces of legislation, with two key texts.On the one hand, the taxonomy regulation provides a classification of economic activities in function of their contribution to the transition. On the other hand, the CSRD requires companies to report on sustainability factors. The underlying logic is that transparent, comparable sustainability reports will facilitate the allocation of capital towards sustainable companies and projects, while avoiding green washing.

The CSRD applies to all large businesses[1] and all listed companies. Entry into force will be progressive.

The reporting requirements contained in the CSRD can be summarized as follows:

- The companies must report on all material impacts, risks & opportunities, policies and objectives in relation to Environmental, Social and Governance matters.

- To identify material elements, the companies must apply the concept of double materiality. This means that they must consider both how the external world impacts the company’s performance (financial materiality), and how the company impacts the external world (impact materiality).

- The companies must describe the due diligence process implemented to inform their materiality assessment.

- The information must cover both the own operations and the value chain of the companies.

- The reports must be set up in accordance with the European Sustainability Reporting Standards (see below).

- The reports must be scrutinized by an audit firm drawing up a limited assurance report.

Axel de Backer also highlighted some key attention points for boards. First, the sustainability report will be public and open to scrutiny by investors and other stakeholders. Disclosures must be carefully considered, in particular from a liability risk perspective. Second, some elements of the directive remain unclear and require legal interpretation: the board should therefore make sure that a proper legal analysis takes place, with the involvement of the legal counsel. Third, preparation is key: an appropriate double materiality assessment and a solid sustainability due diligence framework will be essential both from an operational perspective and from a legal risk perspective.

How to report : the European Sustainability Reporting Standards

The CSRD is rather high level and does not contain detailed requirements. This is why it is complemented by the European Sustainability Reporting Standards (ESRS). The latter specify HOW companies should report on sustainability matters, in a standardized and comparable format. The ESRS are currently being developed by EFRAG, a private advisory group at the service of the European Commission. During our insight session, we were happy to welcome Fredré Ferreira, Leader on Governance at EFRAG. She lifted part of the veil on the ESRS.

She explained the general architecture of the ESRS (see figure below). On the one hand, cross-cutting standards provide important concepts and principles which must be followed when reporting under the CSRD. They also contain overarching disclosure requirements that are universally applicable, regardless of the specific sustainability subject matter (governance of sustainability, how it is integrated in strategy, processes followed to identify risks, impacts and opportunities, etc.).

On the other hand, topical standards cover specific environmental, social and governance topics. Sector specific standards and optional standards for SMEs are also being developed.

Regarding governance, one should note that the requirements of the ESRS focus only on elements relevant to sustainability, such as business conduct (corruption, bribery), and how environmental and social elements are tackled by the governance bodies of the company. There is no overlap with the existing disclosure requirements with regards to governance (for instance the corporate governance statement).

Fredré Ferreira also shared valuable advice for companies wishing to start their sustainability reporting according to the ESRS:

- Inform yourself about the ESRS. EFRAG has developed implementation guidance, as well as a Q&A platform, to assist companies in the process.

- To make your materiality assessment, base yourself on current board discussions & concerns. Start with your own operations, and then collect qualitative information on the value chain.

- Start the reporting by focusing on your own operations.

- Get the right resources on board, and benefit from the expertise of financial reporting experts.

She concluded that “perfect is the enemy of good, but a serious and sincere attempt is required”.

How to go beyond compliance

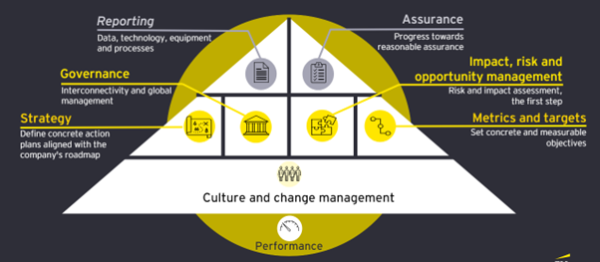

Compliance with the legal rules and standards is one thing. However, reporting as such does not make a company sustainable. During the Insight Session, Sophie Chirez, Climate Change and Sustainability Executive Director at EY Belgium, emphasized that reporting is only the tip of the iceberg when it comes to sustainability.

A sustainable business model also implies appropriate strategy, risk & impact assessment, appropriate metrics, and a strong governance structure. Last but not least, all these elements should be supported by the right company culture.

Based on these insights, Sophie Chirez highlighted key questions that boards can ask to convert sustainability from a compliance exercise to a value creation opportunity:

- How can we cultivate a company-wide culture where sustainability is a fundamental value?

- How can we move beyond compliance to embed sustainability deeply into our company’s creation of value?

- How can we systematically identify and exploit strategic opportunities presented by sustainability regulation?

- Have we put in place the processes and resources to monitor and analyze policy and regulatory developments on a continual basis?

- How can we actively revise our business strategy to incorporate sustainability at its core?

- What specific steps can we take to ensure our leadership drives our sustainability ambitions?

- What new approaches can we adopt to ensure a better balance in our focus on both immediate and long-term sustainable growth?

Some concluding remarks

In this article, we recalled the importance of sustainability reporting for the 3 roles of the board: strategy, oversight and leadership. Next, we provided an overview of the legal rules. This includes the CSRD, which requires companies to report on sustainability factors. This also includes the ESRS, which provides more detailed requirements on how companies should disclose sustainability information under the CSRD. Boards should ensure that the company is compliant with such rules, in particular from a liability risk perspective. Beyond compliance, it is also a task for the board to leverage the sustainability information collected as a tool for action. This way, it is possible to turn sustainability reporting into a value creation opportunity.